Archive

From hardware to services: 4 good reasons why the move is worth it

Working with a tech hardware company these days often doesn’t really feel “hardwary” at all. Even though developing products (laptops, servers, routers, switches, storage devices, you name it) is what they are often very good at and have done for years, everyone seems to be talking about services these days, and how they have, are, or will transform the company into a “services driven business.”

Different companies understand this lock-pick of a phrase differently, but it borders on a rule that at a certain size – and stage in their evolution – most hardware manufacturers stop treating their services business as “necessary evil” and start seeing it as one of the key growth drivers. Together with this recognition also comes better focus on how services, which originally might simply have been given away for free, are monetised for revenue.

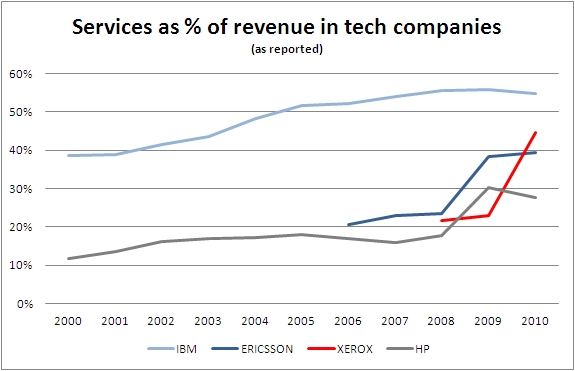

I’ve looked, briefly, at recent sales figures of four global companies with rich legacy of hardware manufacturing: IBM, Xerox, Ericsson and Hewlett-Packard. The graph above clearly suggests that services business in all these firms has played a growing role in the overall sales mix. Some of them jumped on the services gravy train earlier than others, of course, but the trend itself is relatively consistent with all of them.

So why is this the case? What makes services, all of a sudden, such an attractive business to dabble in? Here’s a stab at defining four key reasons (there’s probably dozens more, but these seem to stick out most to me):

- Regularity of revenue flow

When you’re a hardware manufacturer (especially in the B2B market), your sales can get quite lumpy during the year as you often rely on big deals that normally have long sales cycles. The stability, security and repeatability of revenue flow coming from services (many of which are sold on an annuity basis) provides a comfy cushion to top line variability. - Stickiness of customer relationships

Two factors come into play here – firstly, services are usually delivered as part of a long-term contract, with vendor’s employees often based at the customer office. Contacts are made, bonds get created, and the sticky symbiosis emerges. Secondly, in a value-added service model, a vendor often takes control of a set of key processes in a customer’s organization. As a result, the customer often loses the capability to execute these processes using its own internal resources – and can end up effectively locked in a relationship with the supplier (admittedly this is a bit on the “dark side” of business, but is extremely valuable to the vendor). - Healthy margins and simple cost structure

The gap between the hourly pay to your employees and the hourly fee your customers have to pay for the services delivered can be huge – certainly big enough to capture a significant amount of value created in the process. This blog post quotes data suggesting that e.g. Oracle’s services margins can be as high as 74%. For a hardware vendor, traditionally heavily reliant on the cost of components further down the supply chain, this “clean” control of margins is tempting. If you add to this the fact that there is no inventory to maintain and manage (beyond staffing levels, of course, although it feels a bit funny to be referring to people as inventory..), the whole cost structure of the business becomes much more transparent. - Hardware up-sell opportunity

The last, but also one of the most obvious ones. Working day-to-day at a customer’s office, a vendor’s employees have a pretty unique opportunity to identify unmet needs and offer to address them – often outside of formal tender/RFQ process. Once trust is established, the same employees sometimes also become influencers in the purchasing process, helping with initial tender specifications and, effectively, pushing the customer towards decisions favourable to their own company.

Admittedly, none of the four benefits listed is truly ground-breaking or particularly difficult to come up with. They’re quite commonsense, in fact. However, what I find really interesting is the mechanism for hardware companies to decide to jump onto the services bandwagon – what makes them realize the power and potential of services only after years spent in the box-shifting business? Why is it abnormal for hardware vendors to have the insight to offer services (especially value-added services) in a meaningful way at the very onset of their existence?

One thought I have on this is around how the value you deliver to your customers changes as both you and they grow. Smaller vendors tend to lock a lot of the value they create in the products they manufacture, their functions and capabilities – as this is what their small customers expect. As they grow the business, their customers also get bigger and those needs evolve, often becoming too complex for a product to deliver, regardless of how technically advanced it is. That’s probably when vendors get an “aha!” moment, realizing that as specialists in their field they are in a unique position to not only address those evolved needs of their customers, but also capture a good deal of additional value while doing it. And so the transformation to the “services driven business” begins.